Stop Overpaying Income Taxes.

Start Operating Your Wealth Strategically.

You’ve Built Success. Now Build the Structure to Protect It.

We act as a Micro Family Office for high-earning professionals and business owners, integrating advanced tax planning, wealth strategy, and legacy-focused estate structuring into one cohesive system.

Designed for entrepreneurs and families with $1M+ in taxable income who want to turn tax savings into long-term wealth, asset protection, and legacy planning.

You’ve built success. Now build the structure to protect it.

Success Shouldn’t Mean

Overpaying the IRS

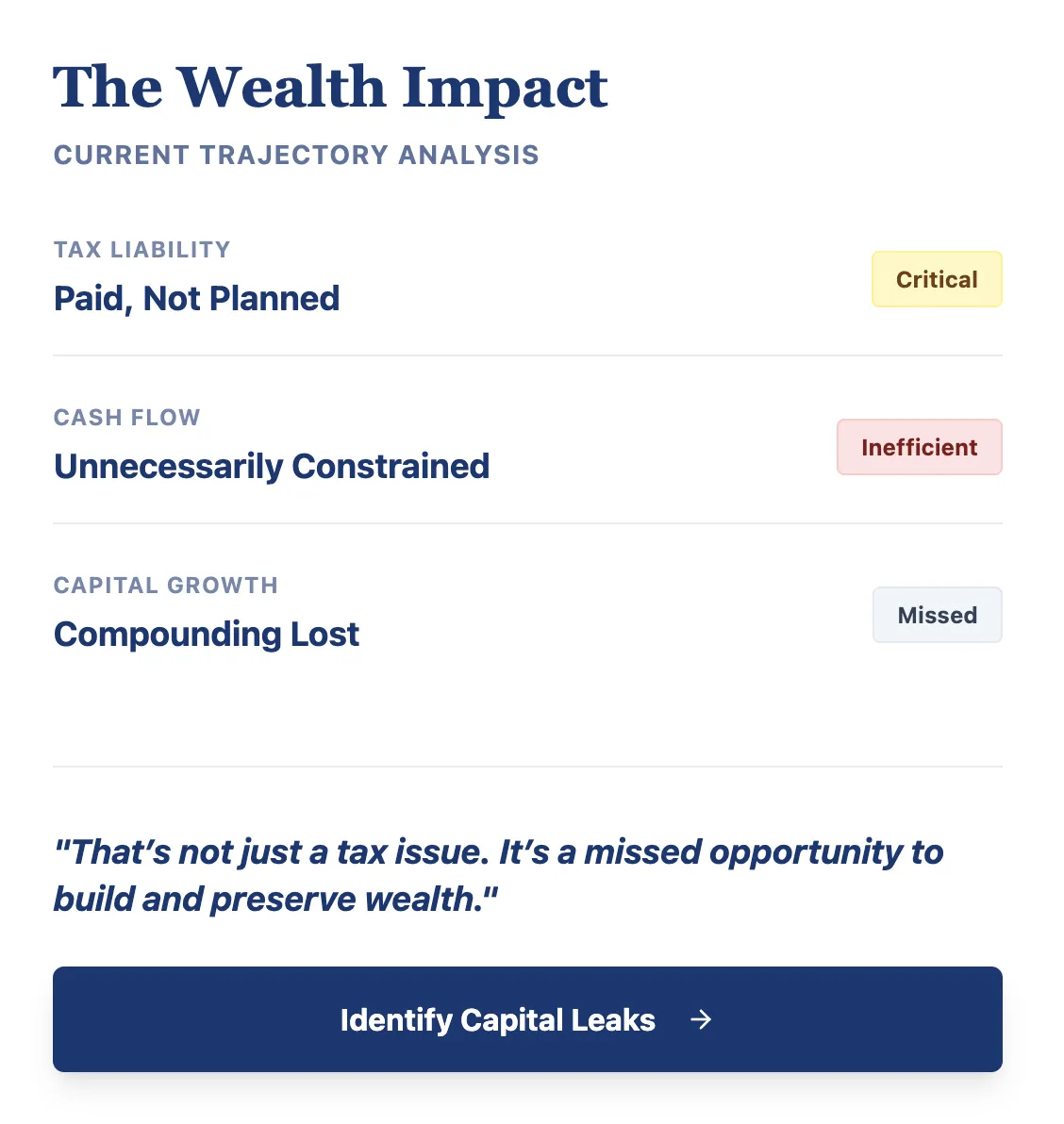

If you’re a high-income professional or business owner, there’s a strong chance you’re paying more income tax than necessary.

Not because you’re careless—but because your financial life has evolved faster than your tax strategy.

Scaled Income S

Expanded AssetsS

New OpportunitiesS

Yet tax planning often remains reactive and isolated—focused on filing and compliance, not proactive strategy.

Success

Shouldn’t Mean

Overpaying the IRS

If you’re a high-income professional or business owner, there’s a strong chance you’re paying more income tax than necessary.

Not because you’re careless—but because your financial life has evolved faster than your tax strategy.

Scaled Income S

Expanded AssetsS

New OpportunitiesS

Yet tax planning often remains reactive and isolated—focused on filing and compliance, not proactive strategy.

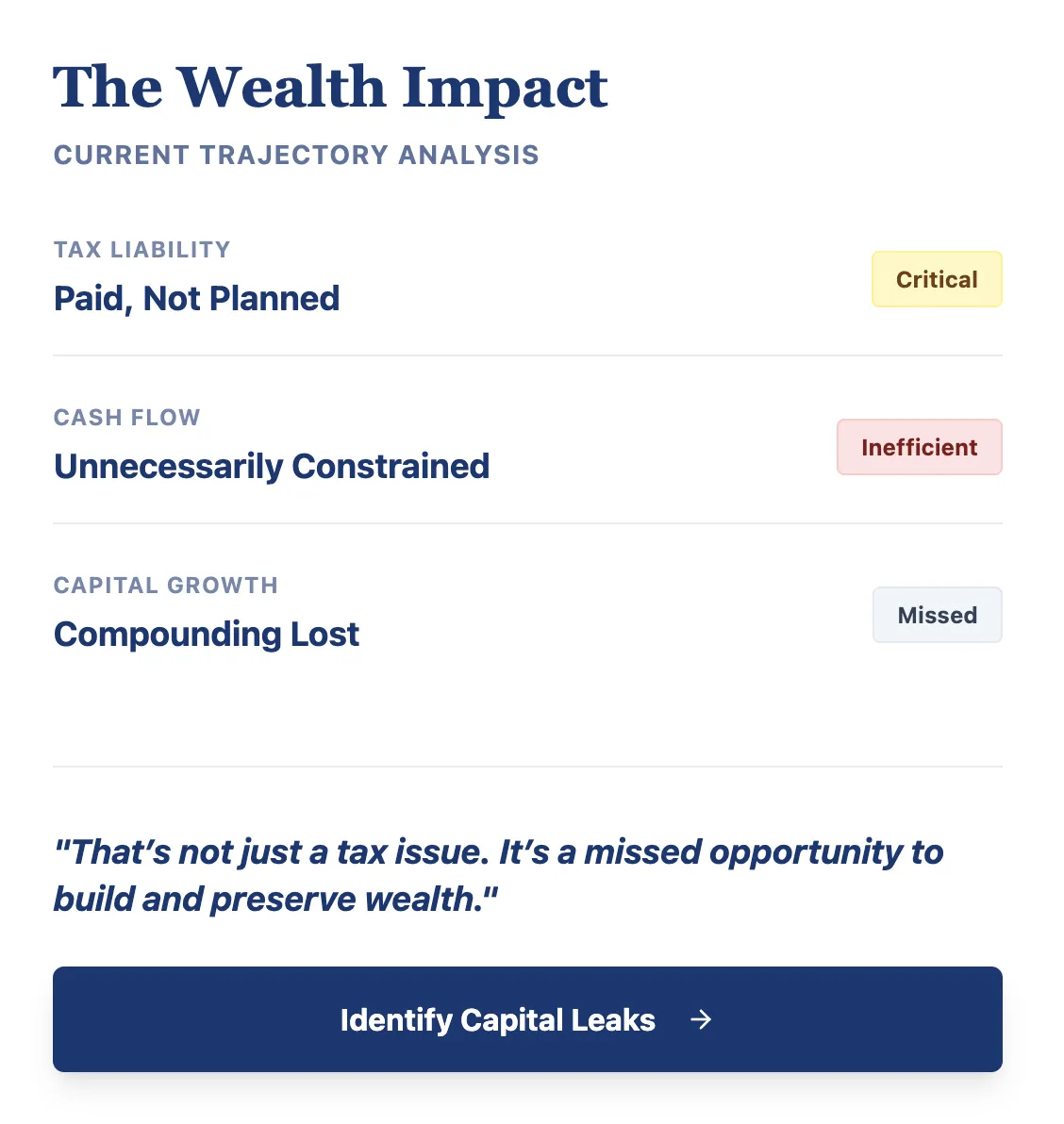

The Cost of Inaction

The financial landscape is unforgiving to those who rely on reactive measures.

The data tells a clear story about where wealth is lost.

93%

of Small Businesses Overpay Taxes

Most business owners unknowingly overpay due to reactive filling and missed strategic deductions

82%

Fail due to Cash Flow Issues

Poor cash flow management is the #1 reason for business failure, often stemming from a lack of CFO-level oversight.

82%

Have No Estate Plan

The majority of Americans leave their legacy to chance, risking probate courts and family disputes.

Integration Is the

New Advantage

True wealth isn’t built in isolation.

It’s built through alignment between what you earn, what you own, and what you envision for the future.

With Ascend Financial Partner, You Gain:

Because when your financial world is integrated, everything flows with purpose.

Unified Operating System

A single, integrated financial ecosystem designed specifically for growth and clarity.

Protective Tax Strategy

Advanced planning for high-income earners to keep more of what you make.

CFO Level Insight

Strategic oversight that supports confident, data-driven decision making.

Trusted Partnership

A dedicated ally who understands both the numbers and your personal narrative.

What We Integrate By Design

From Tax Relief to Financial Control

Step 1: Strategic Tax Planning

Forward-looking tax strategies designed around your income, entities, and long-term goals—moving beyond compliance into optimization.

Step 2: Reinvest Tax Savings Internationally

Saved taxes are redirected into:

Wealth-building strategies

Business growth initiatives

Investment vehicles

Step 3: Structure & Protect the Wealth

We design the legal, tax, and governance structures—entities, trusts, foundations, and operating frameworks—that protect assets and preserve wealth across generations.

Who Are We?

Supported by a team of skilled Certified Public Accountants.

At Ascend Financial Partner, our mission is to bring clarity, confidence, and control to complex financial lives.

We integrate tax, accounting, legal, and financial planning disciplines into one cohesive system—helping high-income earners and affluent families structure, protect, and optimize their wealth.

Through our Micro Family Office framework, we ensure every financial decision works together to deliver lasting security, stability, and strategic growth.

Expert finance Solutions You Can Trust

Why Choose Ascend Financial Partner

Where precision meets partnership — and prosperity aligns with purpose.

In a world of complexity and opportunity, you deserve advisors who not only understand your ambitions but elevate them. At Ascend Financial Partner, we don’t just manage numbers — we integrate every financial element of your life into one clear, coordinated system that supports growth, clarity, and lasting security.

Expert, Integrated Team

Led by CPA and founder Deen Cadi, our team of financial strategists, accountants, and tax planners delivers coordinated, reliable expertise — bringing clarity to even the most complex financial landscapes.

Comprehensive, Cohesive Services

From accounting and tax strategy to CFO advisory and legacy planning, we unify every layer of your financial life. One partner. One system. Complete integration.

Customized Financial Architecture

Your goals, values, and structures are unique — your financial plan should be too. We tailor every strategy to your entity structure, cash flow needs, and legacy vision.

Proven Precision

With over two decades of experience, we’ve built our reputation on accuracy, integrity, and transformative results for high-growth founders and multi-entity families.

Our Process: The Ascend Framework

Discover

Identify inefficiencies, risks, and blind spots

Integrate

align TAX, ACCOUNTING, AND FINANCIAL STRATEGY

Elevate

Implement real-time reporting and accountability

Protect

Build estate, succession, and legacy structures

Each stage delivers precision, partnership, and peace of mind—the foundation of confident financial

leadership.

The Results You’ll Experience

Integrated Financial Clarity — Every number, entity, and advisor connected under one cohesive system.

Tax Efficiency — Lower effective tax rates through proactive planning and compliant structure.

Confidence & Control — Real-time visibility into performance, cash flow, and risk.

Time Reclaimed — Shift from managing details to leading strategically.

Sustained Security — Structured systems that protect assets and optimize wealth over time.

Book a Private Discovery Call

Gain clarity, direction, and confidence in your next financial move. In this confidential consultation, we’ll assess your current structure, identify key opportunities for tax efficiency and integration, and outline a customized roadmap aligned with your goals.

One call can bring your entire financial picture into focus.

Our Service Tiers

Financial Stability for Your Peace of Mind

Our fees are covered by the savings we help you unlock—meaning your investment is paid for through the tax strategies and financial efficiencies we implement.

Foundation

Package

This package offers essential financial services tailored for entrepreneurs and small businesses, ensuring streamlined operations and strategic growth.

Accounting & bookkeeping precision

Proactive tax planning & compliance

CFO Lite guidance

advisor coordination Up to 5 consultations

Monthly 3,500 - 7,500

Strategic

Package

Designed for scaling founders managing growing complexity, this package delivers proactive financial leadership and fully integrated tax and CFO advisory support.

Includes Everything in FOUNDATION, plus:

Full Service Virtual CFO Advisory

Tax Optimization & Entity Structuring

Review of SCorp/LLC strategy for efficiency

Wealth & Cash Flow Coordination

Monthly 7,500 – 15,000

Executive Family Office

Built for founders and families managing significant assets, multi-entity portfolios, or generational wealth—this package provides institutional-grade structure with white-glove coordination.

Includes Everything in strategic, plus:

Full Virtual Family Office Management

Advanced Tax & Strategic Planning

Financial Governance Systems

Dedicated CFO & Advisory Team

Monthly 15,000 – 30,000+

Profits with Purpose.

Legacies Built to Last.

We help visionary leaders and families design purpose-driven tax, wealth, and legacy structures that protect what they’ve built and pass forward what matters most.

Not just wealth—intentional stewardship.

What our Customer are Saying

The accounting services provided by this firm have been exceptional. Their expertise and attention to detail have significantly improved our financial management. Highly recommend!

Cody F.

The personalized service we received from Ascend was outstanding. From tax planning to monthly bookkeeping, their attention to detail and commitment to our success have made a significant difference for our business. Highly recommended!

Kristin Watson

I’ve been working with Ascend Financial for over a year, and their support has been invaluable. They handle my tax filings and financial planning with precision, allowing me to concentrate on my work without worrying about the numbers. Their professionalism is second to none.

Albert Flores

Frequently Asked Questions

What services does your accounting firm offer?

We offer a range of services including tax preparation, bookkeeping, financial planning, audit and assurance, and consulting. Whether you need help with personal or business finances, our team is equipped to assist you with professional and tailored solutions.

How can I schedule a consultation with your firm?

You can schedule a consultation by booking an Ascend Discovery Call on our site.

What are your fees for accounting services?

Our fees vary depending on the complexity and scope of the services required. We offer transparent pricing and provide a detailed estimate after assessing your specific needs. For a personalized quote, please contact us directly.

How do you ensure the confidentiality of my financial information?

We prioritize your privacy and adhere to strict confidentiality policies. All financial information is securely stored and accessed only by authorized personnel. Our firm complies with all relevant data protection regulations to safeguard your information.

What qualifications and experience do your accountants have?

Our team consists of certified public accountants (CPAs) and experienced financial professionals with extensive industry knowledge. Each member of our team holds relevant qualifications and has a proven track record in providing high-quality accounting services.